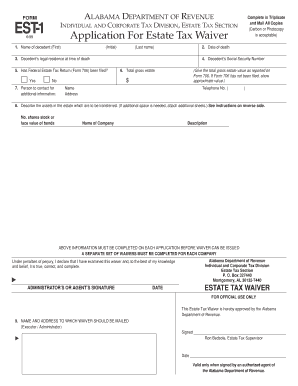

AL Form EST-1 2014-2024 free printable template

Show details

Information about the time zone abbreviation EST Eastern Standard Time ... Also known as: ET Eastern Time, NEST North American Eastern Standard Time .... from Nov 4, 2018 at 2:00 am; UTC Offset: UTC

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your alabama inheritance tax waiver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama inheritance tax waiver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alabama inheritance tax waiver form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit alabama inheritance tax waiver form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

AL Form EST-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alabama inheritance tax waiver

How to fill out alabama inheritance tax waiver

01

Step 1: Obtain an Alabama inheritance tax waiver form. This form is typically available from the Alabama Department of Revenue or the probate court in the county where the decedent resided.

02

Step 2: Gather all the necessary information and documents. You will need the decedent's name, date of death, social security number, and information about the assets being inherited.

03

Step 3: Complete the inheritance tax waiver form. Fill out all the required fields accurately and provide any additional information or documentation that may be requested.

04

Step 4: Review the completed form for accuracy and completeness. Make sure all the information provided is correct and nothing is missing.

05

Step 5: Sign and date the form. Ensure that all required signatures are obtained.

06

Step 6: Submit the completed inheritance tax waiver form to the appropriate authority. This could be the Alabama Department of Revenue or the probate court, depending on the specific requirements.

07

Step 7: Wait for a response. The processing time may vary, but you should receive a notification or confirmation once the inheritance tax waiver is approved and issued.

08

Step 8: Keep a copy of the inheritance tax waiver for your records. It may be necessary to provide it when dealing with inheritances and tax matters in the future.

Who needs alabama inheritance tax waiver?

01

Individuals who are beneficiaries of an estate in Alabama may need to obtain an Alabama inheritance tax waiver.

02

Executors or administrators of an estate in Alabama may also need to obtain an inheritance tax waiver in order to distribute assets to the beneficiaries.

03

Attorneys and tax professionals dealing with estate matters in Alabama may need to obtain an inheritance tax waiver on behalf of their clients.

04

Financial institutions or investment firms may request an inheritance tax waiver before transferring assets to beneficiaries or releasing funds from an estate.

05

Anyone involved in the inheritance process in Alabama should consult with an attorney or tax professional to determine if an inheritance tax waiver is required in their specific situation.

Fill form : Try Risk Free

People Also Ask about alabama inheritance tax waiver form

Is an inheritance taxable in Alabama?

Is there a workaround to inheritance tax?

Who must file Alabama Form 65?

How much can you inherit without paying federal taxes?

Does Alabama require an inheritance tax waiver form?

What is Alabama Form PTE?

Which states have inheritance tax waivers?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find alabama inheritance tax waiver form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific alabama inheritance tax waiver form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit alabama inheritance tax waiver form in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your alabama inheritance tax waiver form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my alabama inheritance tax waiver form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your alabama inheritance tax waiver form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your alabama inheritance tax waiver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.